27+ 38 year mortgage calculator

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower.

Build home equity much faster.

. The following table shows the rates for ARM loans which reset after the seventh year. Canadian bond yields were marginally down on Friday July 14 2017 with the 5-year note down by 124 percent at 1519 and 10-year down by 063 percent at 1898. To avoid the SVR you can remortgage to a better deal which can be a five-year fixed rate mortgage or tracker mortgage.

Core CPI year-on-year Aug. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Use SmartAssets free North Carolina mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Baca Juga

The 366 days in year option applies to leap years otherwise. New Listings Down 15 Calculated Risk Blog - Fri 220 PM NEW Q3 GDP Forecasts. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

This mortgage calculator with extra payment allows you to add extra contribution to every payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR.

Lower interest rates compared to 30-year terms. Need a sample amortization schedule for a 30-year fixed mortgage. 2008 the annual volume of HECM loans topped 112000 representing a 1300 increase in six years.

Mortgage amortization schedule for year 3 2024. And the 51 adjustable rate mortgage rose 375 up 92 basis points. Mortgage interest rates are always changing and there are a lot of factors that.

This shortens their payment duration and helps them save thousands on interest costs. For the fiscal year ending September 2011 loan volume had contracted in the wake of the financial crisis but remained at over 73000. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

But since it pays off your mortgage in half the time it incurs much lower interest charges. 15-year FRMs also come with lower rates by around 025 to 1 than 30-year FRMs. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The loan is secured on the borrowers property through a process. On 3 September 2013 HUD implemented Mortgagee Letter 2013-27.

Are you remortgaging with the. Furthermore compared to a 30-year FRM you save tens and thousands on interest charges with a 15-year FRM. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period.

A 30-year mortgage comes with a locked interest rate for the entire life of the loan. Fed Chair Jerome Powell speaks. Getting ready to buy a home.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. The average cost of a 15-year fixed-rate mortgage has also increased to 438 as of April 21 jumping 209 year-over-year. All inputs and options are explained below.

Mortgage amortization schedule for year 10 2031. Around 1 Calculated Risk Blog - Fri 945 AM. A 15-year fixed-rate mortgage has a higher monthly payment because youre paying off the loan over 15 years instead of 30 years but you can save thousands in interest over the.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 10 years. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page.

Use our mortgage affordability calculator. 15-year FRMs also have rates that are lower by 025 to 1 than 30-year FRMs. Up to five recurring or up to ten one-time lump sum payments.

You will spend on principal on interest. A reverse mortgage is a mortgage loan. If a person.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Current 7-Year Hybrid ARM Rates. People typically move homes or refinance about every 5 to 7 years.

Todays national mortgage rate trends. Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 359 monthly payment. You want a lower interest rate.

The following example compares two mortgages with the same loan amount but with different terms. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

Do not underestimate the one extra payment a year for your mortgage because. Because the rate stays the same expect your monthly payments to be fixed for 30 years. Todays mortgage rates in New York are 5637 for a 30-year fixed 5036 for a 15-year fixed and 5316 for a 5-year adjustable-rate mortgage ARM.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Use our calculator above. Fixed Rate Mortgage Loan Calculator.

Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 718 monthly payment.

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

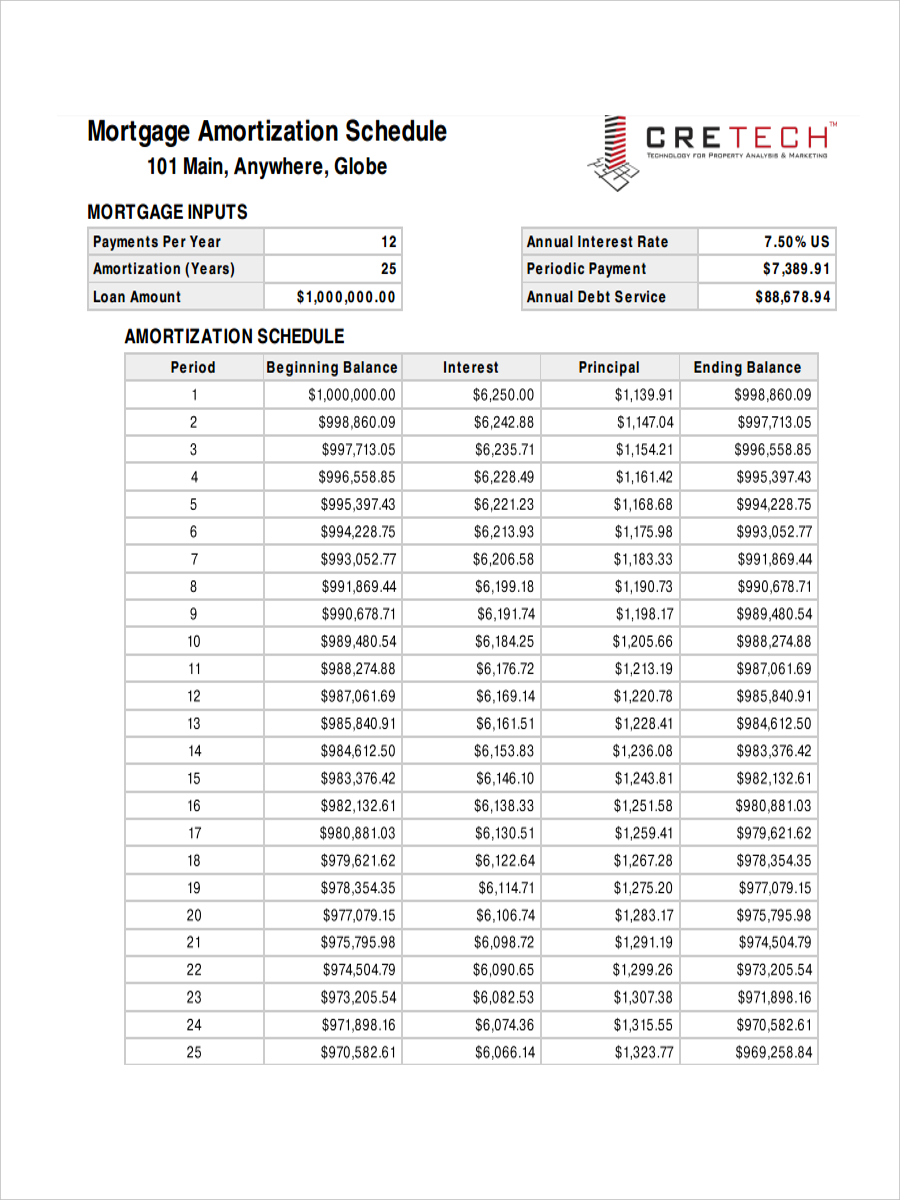

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

Effective Interest Rate Formula Calculator With Excel Template

15 Mortgage Loan Calculators For Wordpress Wp Solver Mortgage Loan Calculator Mortgage Loans Mortgage Calculator

Trend Analysis Formula Calculator Example With Excel Template

Modern Vertical Timeline Infographics Infographic Timeline Design Powerpoint Design Templates

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Maturity Value Formula Calculator Excel Template

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

The Best Mortgage Calculator With Extra Payments Mortgage Calculator Mortgage Tips Mortgage

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Amortization Schedule 10 Examples Format Sample Examples

Effective Interest Rate Formula Calculator With Excel Template

It S Crazy How Much Just 1 Can Impact Your Bottom Line Mortgage Financing Mortgagerates Loan Hom Mortgage Rates Mortgage Payment Mortgage Interest Rates